Advancing Quality Engineering for Banking and Finance: Addressing New Challenges with AI

The financial services industry is undergoing a radical transformation driven by rapid technological advancements and shifting customer expectations. Traditional banking models are giving way to innovative fintech startups and digital banks that prioritize speed, agility, and a customer-centric approach. While fundamental principles such as high-quality service along with effective delivery remain important, the methods for achieving them must evolve in tandem with technological advancements.

This is where AI-powered Quality Engineering for Banking and Finance (QE) comes into play. It represents a paradigm shift from traditional testing methods to a more intelligent and automated approach that leverages artificial intelligence (AI) to address new challenges and ensure the robustness of its digital offerings. According to McKinsey, the potential for AI in banking and finance might reach $1 trillion.

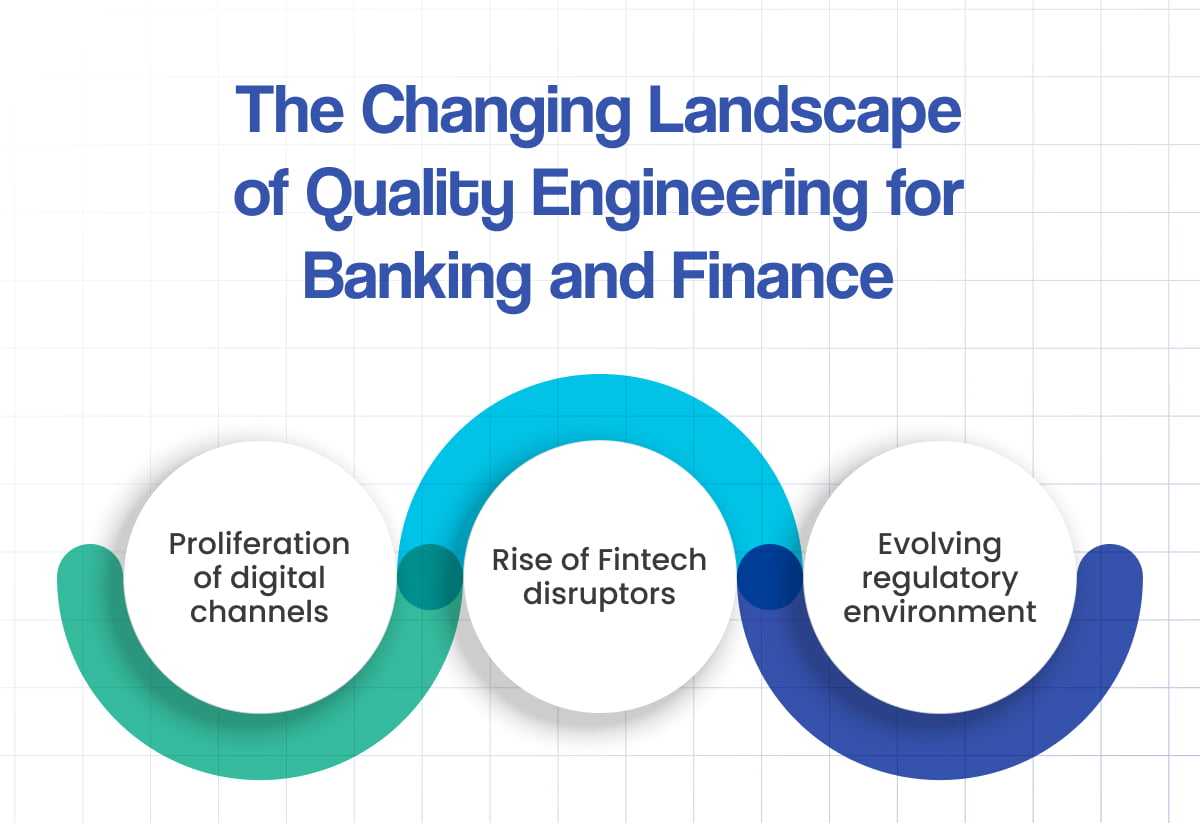

The Changing Landscape of Quality Engineering for Banking and Finance

Historically, Quality Engineering for Banking and Finance focused on meticulous testing, validation, and strict adherence to regulatory compliance. However, the digital age has introduced a wave of complexities:

- The proliferation of digital channels: Mobile banking apps, online portals, and other digital touchpoints require robust testing to ensure seamless user experience and functionality.

- Rise of Fintech disruptors: Fintech startups are pushing boundaries with innovative financial products and services, forcing traditional banks to adapt and innovate to stay competitive.

- Evolving regulatory environment: Regulatory frameworks are constantly adapting to keep pace with technological advancements, making it crucial for banks to maintain compliance.

These factors necessitate a more comprehensive and dynamic approach to Quality Engineering for Banking and Finance.

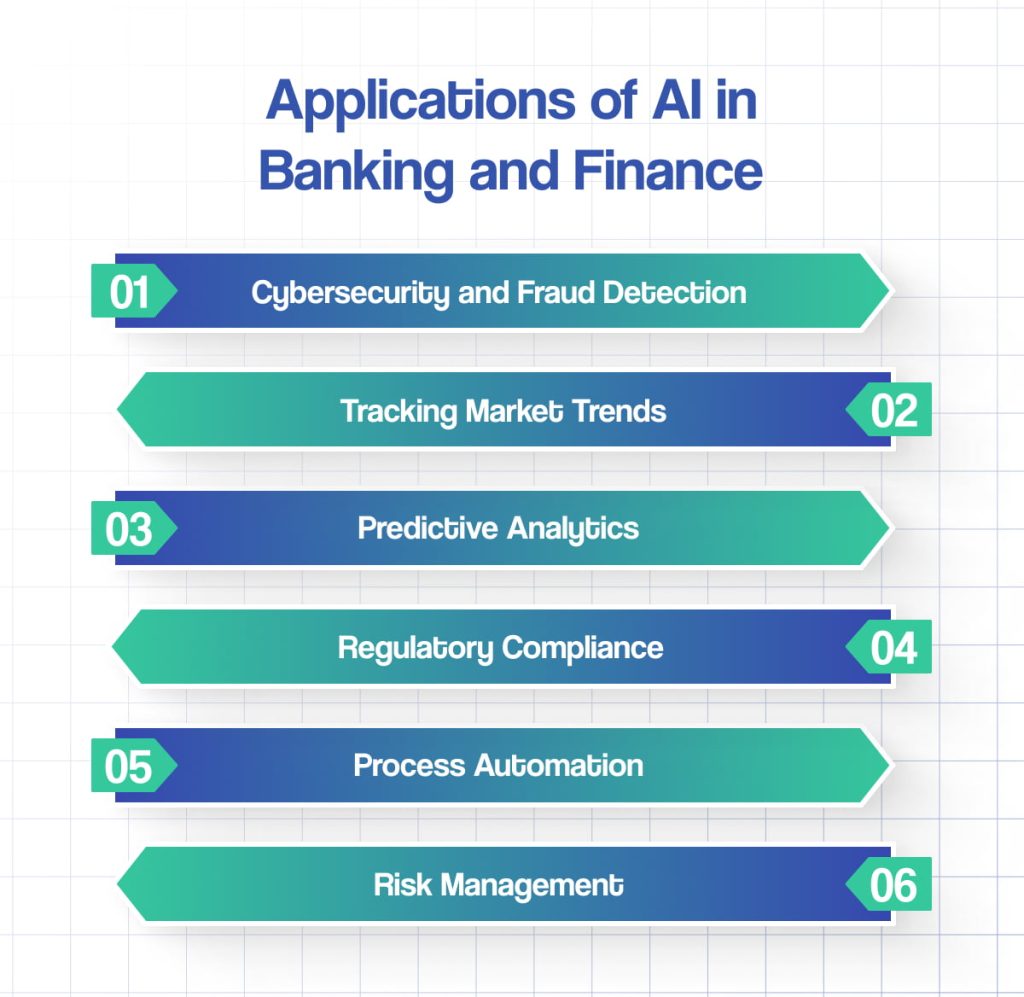

Applications of AI in Banking and Finance

AI applications in the banking and finance sector have reshaped traditional processes and enhanced efficiency and security while offering personalized services to customers. Here are key areas where AI is making a significant impact:

1. Cybersecurity and Fraud Detection

In an era of increasing digital transactions, cybersecurity and fraud detection are crucial for banks. Artificial intelligence, particularly machine learning, plays a crucial role in identifying and preventing fraudulent activities. For instance, Danske Bank, Denmark’s largest bank, implemented a fraud detection algorithm powered by deep learning, resulting in a 50% increase in fraud detection capability and a 60% reduction in false positives. This AI system not only automates critical decisions but also collaborates with human analysts for comprehensive fraud analysis.

2. Tracking Market Trends

AI and machine learning algorithms process vast datasets to predict market trends and investment opportunities accurately. These technologies provide significant insights to banks and clients by evaluating market sentiments and analyzing historical data, allowing them to make informed investment decisions and risk management strategies.

3. Predictive Analytics

AI-powered predictive analytics uncover hidden patterns and correlations in data, resulting in increased revenue and operational efficiency. By discovering untapped sales opportunities and optimizing operational processes, predictive analytics enable banks to make data-driven decisions and optimize business performance.

4. Process Automation

Robotic process automation (RPA) automates repetitive processes to boost operational efficiency and reduce costs. For instance, JPMorgan Chase’s Coin technology exemplifies how RPA accelerates document processing, surpassing human capabilities in speed and accuracy. By freeing up human resources from mundane tasks, RPA enables employees to focus on high-value activities.

5. Risk Management

In a volatile global economy, AI-driven risk management tools help banks navigate uncertainties effectively. By analyzing past behavioral patterns and external factors, such as currency fluctuations and geopolitical events, these tools predict potential risks and enable proactive decision-making to ensure financial stability in turbulent times.

6. Regulatory Compliance

Navigating complex regulations is a significant challenge for banks. AI and natural language processing (NLP) technologies streamline compliance processes by interpreting and implementing regulatory requirements swiftly. While AI complements human compliance analysts, it significantly enhances efficiency and accuracy in adhering to evolving regulatory standards.

Challenges in Adopting AI & ML in Banking and Finance

Introducing advanced technologies like AI into banking operations comes with its share of hurdles. From safeguarding sensitive data to ensuring the quality and interpretability of AI models, banks face several challenges in this transformative journey.

1. Data Security Concerns

The banking sector deals with massive amounts of data, making security a top priority. Safeguarding customer information against breaches and unauthorized access is imperative. Collaborating with technology partners proficient in both AI and banking, capable of offering robust security solutions, becomes crucial to maintaining data integrity and customer trust.

2. Quality Data Accessibility

Effective AI implementation hinges on access to high-quality, structured data for training and validation purposes. Ensuring data reliability is essential for AI algorithms to accurately reflect real-world scenarios. To mitigate the risks associated with poor data quality, banks must examine their data policies to ensure that data is machine-readable and in compliance with privacy standards.

3. Interpretability Challenges

While AI systems simplify decision-making processes, maintaining transparency and interpretability remains a challenge. Biases ingrained in AI models derived from past data might have unforeseen repercussions. Even minor discrepancies in AI outputs can escalate into significant operational issues, jeopardizing the bank’s reputation and functionality.

The Role of AI in Quality Engineering for Banking and Finance

AI can significantly enhance Quality Engineering for Banking and Finance by automating repetitive tasks, improving test coverage, and identifying potential issues faster. Here are some key areas where AI can make a difference:

- Security Testing: AI-powered security solutions can continuously scan for vulnerabilities in code, network infrastructure, and applications, curbing the risk of cyberattacks and financial fraud.

- Performance Testing: AI can assess user behavior patterns and predict potential performance bottlenecks, helping banks ensure optimal application responsiveness across various user loads.

- Accessibility Testing: AI tools can automate accessibility testing, guaranteeing that digital channels are inclusive and usable for individuals with disabilities.

- Data Integrity Testing: AI can be used to identify and prevent data anomalies, ensuring the accuracy and consistency of financial data.

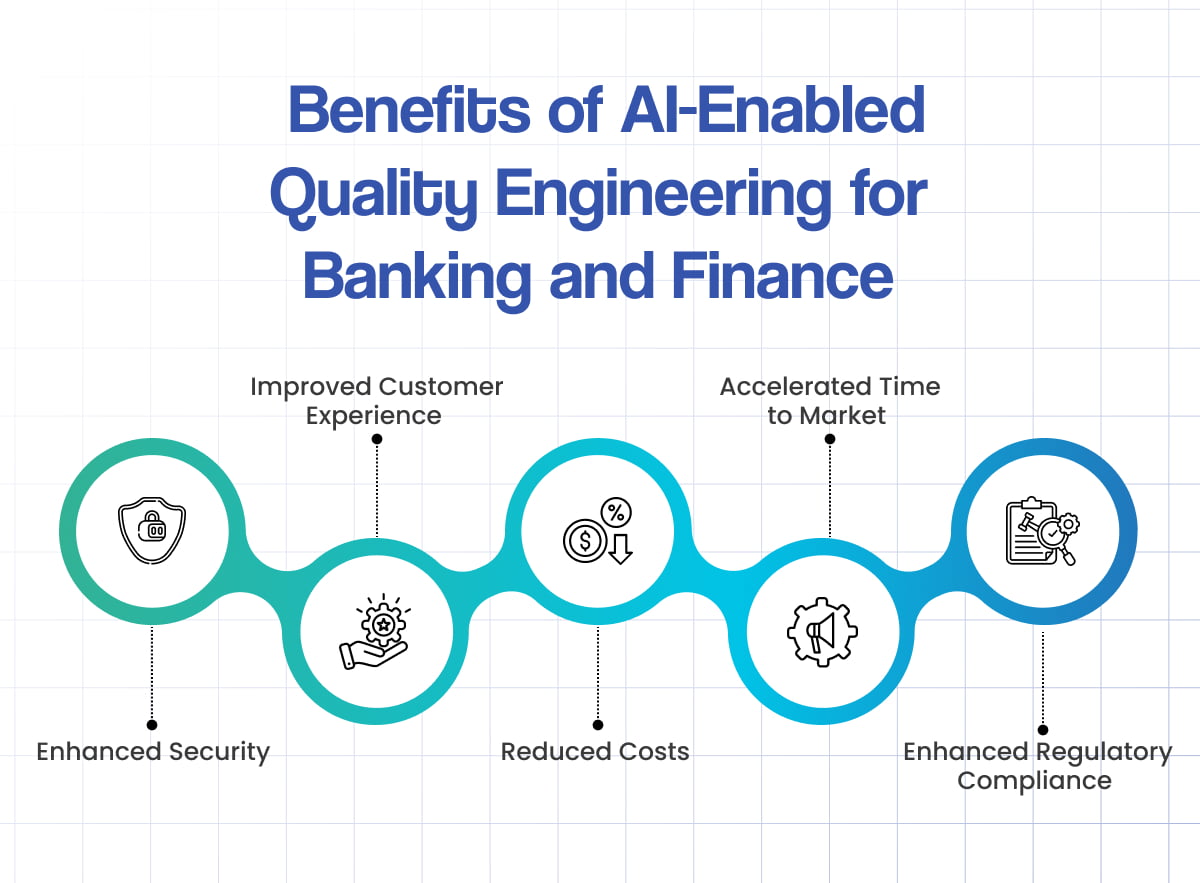

Benefits of AI-Enabled Quality Engineering for Banking and Finance

Integrating AI into Quality Engineering for Banking and Finance yields a robust array of advantages that revolutionize operational dynamics and fortify customer trust:

1. Enhanced Security

AI-driven security testing strengthens banking systems and protects sensitive customer data from breaches and unauthorized access. AI can spot anomalies and vulnerabilities quickly using advanced algorithms. This enables preemptive efforts to prevent potential security breaches before they escalate into crises.

2. Improved Customer Experience

The seamless integration of AI improves the performance and usability of digital platforms, culminating in a superlative customer journey. By methodically monitoring user interactions and comments, AI systems may identify patterns, preferences, and pain areas, allowing banking interfaces and services to be fine-tuned to meet client expectations. This improvement increases engagement, builds loyalty, and cultivates long-term consumer connections.

3. Reduced Costs

The automation of manual testing processes frees up important resources and reduces the cost load associated with quality assurance. Banks can expedite testing methods by leveraging AI-powered testing frameworks, greatly reducing the requirement for human interaction and lowering costs associated with labor-intensive testing efforts. This cost optimization allows banks to spend resources wisely, directing them toward innovation and strategic projects that create long-term growth.

4. Accelerated Time to Market

Automated testing reduces feedback loops, improving agile development cycles and accelerating the release of new features and products. By automating regression testing, performance testing, and other essential QA activities, AI allows banks to quickly discover and correct faults, reducing time-to-market for new offers. This agility in product delivery boosts competitiveness, allowing banks to grab emerging opportunities and capitalize on market trends with unprecedented speed.

5. Enhanced Regulatory Compliance

AI-driven analytics furnishes banks with a potent toolset for preemptive identification and resolution of regulatory compliance issues. By scrutinizing vast datasets and detecting aberrations indicative of potential compliance lapses, AI augments banks’ capacity to uphold regulatory standards and navigate the intricate regulatory framework with precision. This proactive approach not only averts regulatory penalties but also encourages a culture of integrity and accountability within the organization.

How ImpactQA Can Help in Your AI for Banking and Finance Journey

As a premier software testing and QA company specializing in FinTech, ImpactQA collaborates with banks and financial institutions to conduct rigorous testing of AI and ML-based models. Our services aim to optimize revenue, reduce costs, and mitigate risks across various departments. Leveraging our experts’ profound knowledge of artificial intelligence and the banking sector’s specific challenges, we facilitate the development of AI-powered solutions that enhance risk management, automate processes, and elevate customer experiences.

Our comprehensive approach equips us to assist in crafting and implementing tailored, long-term AI strategies that meet your organization’s specific needs. By prioritizing data security, quality assurance, and interpretability, we empower banks to confidently navigate the evolving AI landscape while delivering exceptional financial services to their clients.

Partner with ImpactQA to drive transformative changes and excel in the competitive digital market.